The President’s Framework for Business Tax Reform

Special Complimentary Report from the FreedMaxick Tax Team

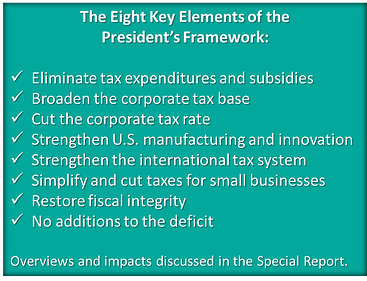

President Obama recently released his Framework for Business Tax Reform. While not enacted into new legislation or regulation, the Framework has the potential to impact virtually every single business in the United States.

President Obama recently released his Framework for Business Tax Reform. While not enacted into new legislation or regulation, the Framework has the potential to impact virtually every single business in the United States.

Get acquainted with the President’s proposals and join the dialogue with this free resource from the Tax Team at FreedMaxick.

Inside:

- How the corporate tax rate might be cut … and by how much

- Will your business be a winner or a loser in the tax rate restructuring?

- Plans for expanding Code Sec. 199 deductions – will you be eligible?

- Will your business be losing tax preferences?

- Is repeal of LIFO on the horizon?

- Which tax extenders are going to be allowed to expire

- Will the Research Tax Credit be extended?

- What is the Administration thinking about minimum taxes overseas profits?

- Provisions that will simplify the Tax Code for small business

…and much more!

Get this complimentary special report immediately by completing and submitting the information below. For a more extended discussion about how these proposals might affect your business, call us at 716.847.2651 for a confidential discussion of your situation.