Freed Maxick Business Valuation Team

5 Factors to Consider When Determining the Frequency of Business Valuations

During the life of a business, several events will make a business valuation necessary, such as buying or selling a business, admitting or buying out a shareholder, or valuing a company for estate taxes. If tracking the value of your business to help with estate, exit or succession planning (which we recommend), then you may also need to consider how often a business valuation needs to be performed.

During the life of a business, several events will make a business valuation necessary, such as buying or selling a business, admitting or buying out a shareholder, or valuing a company for estate taxes. If tracking the value of your business to help with estate, exit or succession planning (which we recommend), then you may also need to consider how often a business valuation needs to be performed.

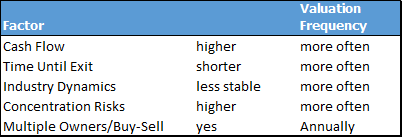

There is no right answer, but several factors should be considered, shown in Figure 1 and discussed below.

Figure 1. Factors to Consider in Determining Frequency of Valuations

The Practical Matter of Cash Flow and Profitability Affects Frequency of Business Valuations

The first factor to consider is a practical matter – how often can you afford to have business valuations performed?

If your company does not produce any cash flow for the owners, then there is likely little business value or need to have regular valuations performed. If the company is producing significant amounts of cash flow for the owners, then you may want to measure value more frequently. A good way to think about the cost is similar to how you would pay a wealth advisor based on a percentage of assets under management. Set aside a percentage of your company’s value to use for activities to manage the wealth tied up in the business including valuations, legal reviews, updating buy-sell agreements, etc.

Time Until Exit Affects Frequency of Business Valuations

Business valuations can be used to understand what the key value drivers and risks are for the business. This information can be used to help increase the company’s value as you move closer to selling the business.

If you are a long way from exiting the business, then an occasional checkup will suffice. If you are within five years from selling the business, then you will want to have more frequent checkups to make sure you are on track for increasing value and reducing risk to assure you can get the best deal when you do exit.

Industry Dynamics Affects Frequency of Business Valuations

A company operating in a stable industry such as consumer staples or utilities is less likely to have large swings in value due to industry trends.

Companies operating in industries with constant change such as technology or healthcare are more likely to see large swings in value from industry trends and should have valuations performed more frequently relative to companies in stable industries.

Concentration Risks Affects Frequency of Business Valuations

For small companies, significant swings in value can result from concentrations of business with a small number of customers, concentration in a limited geographic market or a static amount of products or services.

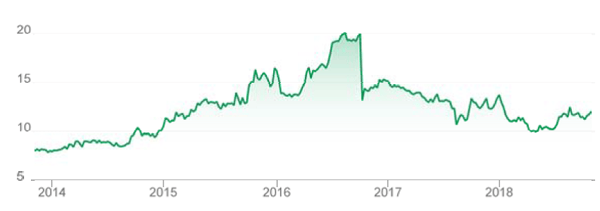

Consider the volatility in stock price for a local small publicly traded company in Figure 2 which relies on around a half-dozen customers for about half of its revenues. Large swings in price were mostly caused by announcements of new large contracts from those key customers.

This company’s market capitalization increased about 2.5x between the end of 2013 and the middle of 2016 and is now around 60% of its 2016 peak.

Figure 2. Stock Chart for Small Local Publicly Traded Company

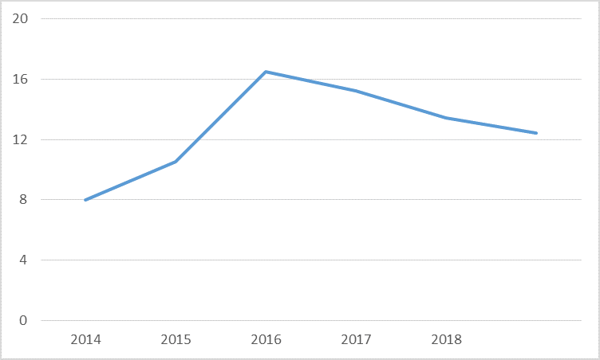

Now consider Figure 3, which shows the stock chart if the company was not publicly traded and just measured value through annual appraisals. This is deceiving because the company’s value appears much more stable than it actually is.

More concentration risks make a company’s value more volatile, which means you should measure the value more frequently.

Figure 3. Stock Chart if Not Publicly Traded and Valued Annually

Having Multiple Owners Affects Frequency of Business Valuations

If your company has multiple owners, then an annual valuation can help to keep everyone on the same page in terms of expectations for pricing in the event that one of the owners needs to be bought out.

This will help to reduce the likelihood of shareholder disputes and litigation. If you have multiple owners, we recommend having annual valuations performed to update the pricing in your buy-sell agreement.

Let’s Discuss Best Practices for the Frequency of Business Valuations for Your Business

For a much more thorough discussion of the appropriate frequency of having valuations done for your business, contact me (Tom Insalaco, 716-622-9680, thomas.insalaco@freedmaxick.com) or another member of the Freed Maxick Business Valuation Team.

Let’s talk about getting an updated business valuation as a key milestone. Freed Maxick will conduct a comprehensive analysis of your company, perform market research, and develop documentation showing the true financial operating potential of your business.