Freed Maxick Tax Team

April 15 is usually a happy day for tax practitioners and taxpayers alike. April 15, 2019 was not a happy day for Siemer Milling Company and their tax advisors after Siemer Milling Company v. Commissioner (TC Memo 2019-37) was decided. This case focused on seven projects the company claimed the R&D tax credit on in 2011 and 2012.

April 15 is usually a happy day for tax practitioners and taxpayers alike. April 15, 2019 was not a happy day for Siemer Milling Company and their tax advisors after Siemer Milling Company v. Commissioner (TC Memo 2019-37) was decided. This case focused on seven projects the company claimed the R&D tax credit on in 2011 and 2012.

Here’s a summary of Freed Maxick’s R&D Tax Credit Team’s perspective on this case and its consequences for the credit:

R&D Tax Credit documentation is KEY.

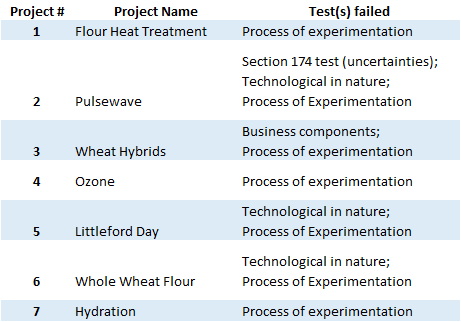

As you can see from the chart below, ALL seven projects reviewed were denied as Siemer Milling Company was not able to prove they engaged in a process of experimentation (and in some instances other parts) of the 4-part test.

The big takeaway from this case is that it reinforces the fact that documentation is vital to the successful claim for R&D tax credit. IRS stated that “the record is devoid of evidence that petitioner formulated or tested hypotheses, or engaged in modeling, simulation, or systematic trial and error…” Unfortunately for the taxpayer, the Tax Court agreed and denied each project!

Based on the results of the case, three of the seven projects would appear to have qualified for credit (#’s 1, 4 and 7 in the chart above) if there was sufficient documentation to a process of experimentation.

Key takeaway…document, document and document!

Siemer down, it wasn’t all bad for other taxpayers!

The IRS took draconian positions in a few areas that the Tax Court summarily shut down!

- Uncertainties - IRS asserted that Siemer could not face the same uncertainty for more than one year. The tax court responded that this argument was unpersuasive and that Siemer “could have faced the same uncertainties for several years in a row and not all uncertainties are neatly resolved within the confines of a single taxable year.”

- Education - IRS asserted that Siemer could not have engaged in R&D activities as they did not employ anyone with the title of engineer or anyone with an engineering degree. The tax court responded that this argument was unpersuasive and that nothing requires a taxpayer to employ or contract with someone with a specialized degree to prove that research relied upon physical or biological sciences, engineering, or computer science.

- Multiple tax periods - IRS asserted that Siemer could not have “new” projects for more than one year. The tax court responded that this argument was unpersuasive and that “the development or improvement of a business component can span more than one tax year.”

Uncertainties and projects themselves spanning multiple tax periods is VERY common. Not only could projects that start very late in a year continue into the subsequent year, some projects are very complicated and time consuming, which could result in the project spanning more than two tax periods. We agree with the courts argument that this is unpersuasive and doesn’t have any standing in the legal statute or case law.

While education may be very important for a taxpayer’s employees to perform their function, there is no statute or legal requirement that a skilled tradesmen (or anyone else for that matter) without a formal education isn’t performing R&D for a taxpayer. You have to look at the ACTIVITY not the EDUCATION of the individuals engaging in R&D.

Key takeaway…it is the activity that matters, not when or how it is done!

Connect with Our R&D Tax Credit Experts for More Information

The Research and Development Tax Credit experts at Freed Maxick are standing by to help review your situation and provide guidance on both your eligibility for the credit, and the scope and processes necessary for its capture and claim.

The Research and Development Tax Credit experts at Freed Maxick are standing by to help review your situation and provide guidance on both your eligibility for the credit, and the scope and processes necessary for its capture and claim.

To schedule a complimentary review, call me at 716-847-2651, reach me via email at joe.burwick@freedmaxick.com, or simply click on the button to complete and submit a meeting request.