Freed Maxick Tax Team

A Renewed Tax Headache for Your Manufacturing or Distribution Business?

At the end of 2021, effective July 1, 2022, the Infrastructure Investment and Jobs Act reinstated long dormant excise taxes earmarked to fund the Hazardous Substance Superfund Trust … with a few twists.

If you are a manufacturer/distributor, producer, or importer using a select group of chemicals in your product(s), it’s likely that this tax will have significant financial, administrative, and operational impacts.

It may be your responsibility to pay this tax upon the purchase, manufacturing and/or importation of the chemicals. Even for those companies that complied with the original tax until its expiration in the 1990’s, there are many critical differences in this new version, ranging from applicable tax rates on chemicals to thresholds for determining which chemical substances are taxable, and more.

Even though guidance and regulations have not yet been finalized, it’s the opinion of the Freed Maxick Tax Team that calculating this new tax will be a heavy lift. The timing is right to consult your tax advisor on the applicability of this tax to your situation, and to discuss the timing of compliance requirements.

IRC Section 4661 – Imposition of Chemical Tax

IRC Section 4661 imposes a tax on 42 specific chemicals sold by the manufacturer, producer, or importer of the chemical. The applicable tax ranges from $.48 to $9.47 per ton.

IRC Section 4661 imposes a tax on 42 specific chemicals sold by the manufacturer, producer, or importer of the chemical. The applicable tax ranges from $.48 to $9.47 per ton.

For purposes of this code section the term “importer” means the person for which the taxable chemical is brought to the U.S. for consumption, use or warehousing. This is the first person/company at which the taxable chemical lands in the U.S. for the preceding reasons.

Superfund Excise Tax Exemptions

Several exceptions apply to the tax such as substances used in the production of certain fertilizers, animal feed, and motor fuel, among others. Additionally, IRC Section 4662(e) provides an exemption on the sale by the manufacturer or producer for resale for export.

The burden of proof for claiming one of these exemptions rests with the taxpayer. It is our recommendation that any proofs supplied to the IRS be done in conjunction with your tax advisor.

IRC Section 4671 – Imposition and Calculation of Chemical Substance Tax

IRC Section 4671 imposes a tax on any taxable substance as defined in IRC Section 4672 which, at the time of sale or use by the importer, is listed as a taxable substance by the Secretary.

IRC Section 4672 defines a taxable substance as a substance which the taxable chemicals constitute more than 20 percent of the weight (or more than 20 percent of the value) of the materials used to produce such substance (determined based on the predominant method of production).

Like the tax imposed under IRC Section 4661 generally, the tax is imposed on the importer of the taxable substance the moment that substance enter the production facility of warehouse from an origin outside the U.S.

For importers of products that contain these substances, the computational procedures that may be required can quickly become complex and overwhelming. First, an importer needs to determine whether the 20% threshold is met.

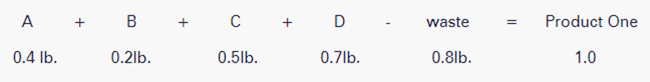

For example, let’s assume that one pound of product contains four chemical components utilizing the following quantities:

Let’s assume only chemical A is a taxable substance. Of the 1.8 lbs. of chemicals consumed in order to make Product One .4 lb. or 22% related to chemical A, and therefore Product One would be considered a taxable substance.

Once it is determined the threshold is met, the next step is to determine the applicable tax rate imposed on the substance. If product A is Butane - taxed $9.74 per ton - this substance would have an applicable tax base of $2.14 ($9.74 x 22%) per ton. One can quickly see how this exercise can be quite burdensome.

Alternatively, if the taxpayer does not wish to provide sufficient information to determine the amount of tax to be imposed on the imported substance (i.e. go through all those previous math gyrations), taxpayers will be imposed tax at a rate of 10% of the substance's appraised value.

Superfund Tax Next Steps

Companies impacted by the reinstatement of the new excise taxes will need to assess their responsibility for collecting and remitting the excise tax. They must identify how to capture the required data for applicable transactions and/or prepare or obtain necessary reports to support a compliance filing.

Companies impacted by the reinstatement of the new excise taxes will need to assess their responsibility for collecting and remitting the excise tax. They must identify how to capture the required data for applicable transactions and/or prepare or obtain necessary reports to support a compliance filing.

Some troublesome news: Although you might make a determination that your company is not responsible for these excise taxes, be aware that if your supply chain still includes these chemicals and substances, it will be necessary to contact your suppliers to determine what impact these excise taxes will have on your overall supply chain and cost makeup.

As with many tax discussions, the devil is in the details, but we don’t even have all those details yet. Be sure to subscribe to Freed Maxick’s email updates using the form on this page for new information as it becomes available.

Meanwhile, if the issues discussed in this article have you wondering if your business should prepare for the next round of Superfund Excise Tax considerations, it’s never too early to start the discussion. Please contact Freed Maxick via our contact form or call Nick Zoyhofski, Senior Manger at 716.362.6219 to discuss your situation.