Freed Maxick Higher Education Team

Nine Tactics for Hanging on to Your Endowment

The coronavirus has created a “perfect storm” of financial challenges across higher education – a witch’s brew of dealing with uncertainty in college enrollments, affordability of current and rising tuition costs, and institutional expenses that constantly need pruning. Many university and college presidents and their executive team members are wrestling with how to keep their institutions financially solvent, including tapping into the Institution’s endowment funds by increasing the spending rate or extracting an emergency distribution. But is tapping endowment funds the best possible option to deal with these financial crises?

Many Institutions Tapped Their Endowments to Cover Expenses During Fiscal Year 2020

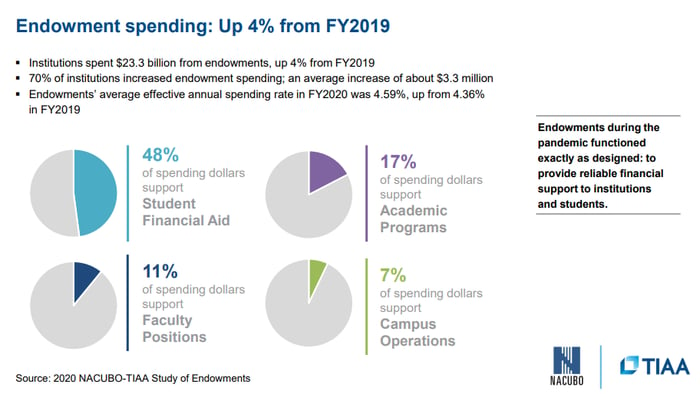

In 2020, the National Association of College and University Business Officers (NACUBO) and financial services insurance company (TIAA) teamed up on the NACUBO-TIAA Study of Endowments 2020. The study revealed that many institutions tapped their endowments further to cover expenses to support their students and their mission during fiscal year 2020 – a $23.3 billion impact representing an increase of 4% from fiscal year 2019. Seven out of ten institutions reported that their spending was up by an average of $3.3 million from fiscal 2019.

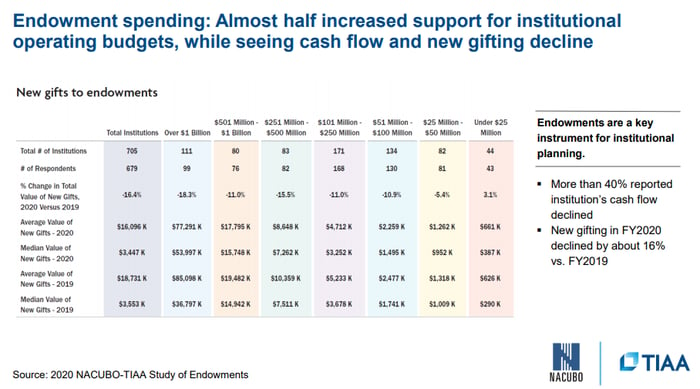

Gift giving to an institution is a very important aspect of supporting its mission, generating cashflow and a main contributor of lowering its tuition dependency. However, with the shift in mindset to preserving operations during the COVID crisis, many schools are now bolstering their annual fund campaigns (often receiving unrestricted support) as opposed to fueling their endowments, which is a more longer-term strategy.

Institutions still need to pay attention to the spending restrictions of incoming donor contributions. This means maintaining accurate financial records and documentation of original gifts and keeping the donor’s wishes in mind when creating appropriations.

Asset Allocations Vary by Size of Endowment

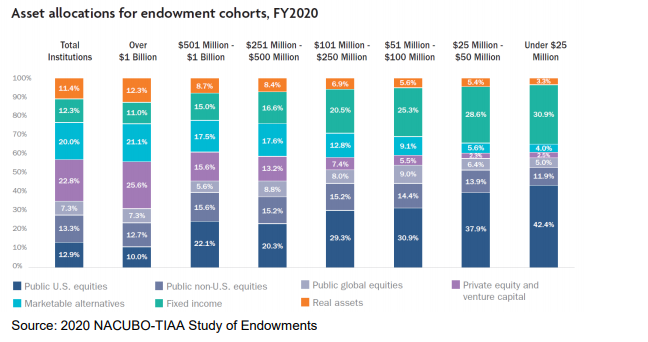

The NACUBO-TIAA Study of Endowments 2020 also reported asset allocations among the responded institutions according to the size of their endowment. Smaller endowments had the most invested in Public U.S. equities and fixed income, while larger institutions with more vast and mature endowments held greater weight in Public non-U.S. Equities and alternative investments.

“The one-year performance figure reflects the reality that few market sectors were immune to the steep downturn in early 2020 and most markets had not fully recovered by the time the fiscal year ended on June 30,” said Doug Chittenden, Executive Vice President and Head of Institutional Relationships, TIAA. “But going forward, if returns continue to fall short, endowments will need to consider all their possible levers for meeting their targeted return rate,” he said. “An endowment can consider adopting more risk and exploring changes in portfolio construction.”

Institutional Endowment Management and Best Practices During COVID

With increased endowment spending and uncertainty in financial markets, consider the following action steps your institution can take today to exercise their fiduciary control over its endowment:

- Periodic rebalancing of your endowment portfolio along with an in-depth review of its asset classifications. Also consider establishing investment ranges of each asset class instead of set percentages.

- Consider updating your Investment Policy along with periodic refreshes

- Conduct periodic benchmarking metrics on fund performance

- Conduct an in-depth review of your endowment fees, both advisory and investment brokerage

- Often times you may be paying for services you are not receiving the full benefit from – take an inventory and develop a plan to utilize all services that are being offered by your current investment advisor

- Encourage other committees to participate in investment discussions outside of your Investment Committee; IE – Finance, Governance, Full Board of Trustees.

- Inform prospective donors about recent tax legislations to aid with charitable contributions that could provide a valuable tax benefit

- Consider embarking on a request for proposal (RFP) over management of your endowment. This is considered a best practice, but is a time-intensive process involving interviews, evaluations and reconfiguring investment platforms, oftentimes the benefits will outweigh the upfront personnel cost.

- Challenge your current investment advisor and include in future RFP’s to participate in non-advisory services to support key institutional initiatives:

- college career days;

- internship programs for students;

- financial wellness and debt management seminars;

- sponsorship opportunities in connection with major fundraising initiatives;

- institutional advancement support for soliciting donors and

- recommendations for up to date gift vehicles

- Conducting research on your inventory of donor restrictions within the portfolio;

- This will identify spending shortfalls due to excessive donor restrictions. A simple dialogue between the donor could lead to modification and/or removal of their restriction.

Connect with Freed Maxick’s Higher Education Team

If you have any concerns or issues about university endowment investment strategy, please do not hesitate to connect with me and higher education team at 716.336.7067. Let’s schedule a complementary discussion to explore issues, opportunities, and solutions for maintaining your fund as we emerge from the COVID-19 battleground.

Resources and References

For more information on NACUBO-TIAA Study of Endowments 2020, please visit: https://www.nacubo.org/Research/2020/NACUBO-TIAA-Study-of-Endowments

https://www.nacubo.org/Research/2020/COVID-19%20Research/Q1%202020%20Endowment%20Survey