Sandra York, CPA

You may still be able to use credits even if they’re greater than your tax liability

With businesses and individuals in full swing planning for filing their 2017 taxes, to the extent possible, it’s important that General Business Credits not be overlooked. In fact, this topic should be on your discussion list, and this blog post can help you understand the current and past opportunities you may have.

With businesses and individuals in full swing planning for filing their 2017 taxes, to the extent possible, it’s important that General Business Credits not be overlooked. In fact, this topic should be on your discussion list, and this blog post can help you understand the current and past opportunities you may have.

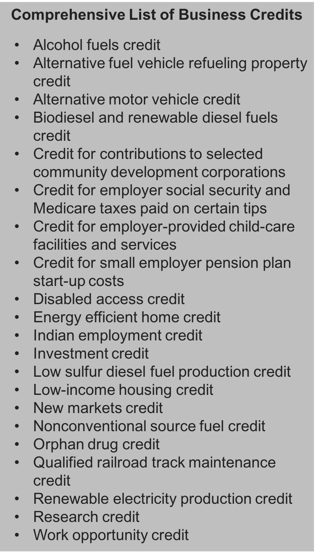

The General Business Credit is a collection of different credits available to both business and individual taxpayers., computed on specific tax forms. If you qualify for more than one type of credit, your tax consultant will file Form 3800. It’s important to note that any credit may be subject to a limitation based on your tax liability.

The General Business Credit is a collection of different credits available to both business and individual taxpayers., computed on specific tax forms. If you qualify for more than one type of credit, your tax consultant will file Form 3800. It’s important to note that any credit may be subject to a limitation based on your tax liability.

The credits individual taxpayers will be most familiar with include those for energy efficient homes and electric cars.

However, many individuals who are shareholders in an S-Corp or partners in a partnership may be familiar with those credits available for increasing research activities, disabled access, work opportunity, etc.

When the Tax Credit Exceeds the Tax Liability…

In certain situations, these credits can be substantial and you could run into the situation where the credit you are entitled to exceeds your tax liability for the year which could typically happen in a year when you experience a net operating loss.

Important note #1: Unused credits may be carried forward to be used over the next 20 years.

Important note # 2: General Business Credits may also be carried back one year, to the first preceding tax year, as long as the particular credit you are claiming was allowable in that tax year. This would generate a refund of tax paid for that prior year, and can be accomplished easily for individuals or businesses by filing the appropriate form to apply for a tentative refund of tax, rather than having to amend prior returns.

Important note # 3: Any unused credit left after the carry back can then be carried forward twenty years.

General Business Credit Carryback Example …

One of Freed Maxick’s clients had a significant credit that could not be used this year due to a net operating loss generated by changing the method of accounting. By carrying that credit to the prior tax year, the client was able to receive a significant refund of tax paid that year.

The moral of the story: don’t overlook the ability to carry back those credits.

Connect with the Tax Experts at Freed Maxick

If you’re interested in minimizing your current, past or future Federal and State tax obligations, give our tax team a call at 716.847.2651, or connect with a simple click.

If you’re interested in minimizing your current, past or future Federal and State tax obligations, give our tax team a call at 716.847.2651, or connect with a simple click.

Let us show you why “Trust Earned” is a lot more than a slogan – it’s the core of our mission and business purpose.